Blogs

To the definition of foundation to your purposes of anyone provider bodies’ promotion, find Publication RC4034, GST/HST Public service Bodies’ Rebate. Calendar quarter setting a time period of three months birth for the first-day from January, April, July, or Oct within the per season. One of several wagering applications offered to Australian punters, BetEasy shines on the complete and you may representative-friendly golf betting possibilities. Be it the fresh Huge Slams, ATP, WTA, ITF, or perhaps the Adversary Trip, BetEasy discusses all of it, bringing an extensive variety of metropolitan areas for each feel.

Is also landlords costs dogs places?

It indicates you have got the brand new financial obligation, as well as registering, charging, get together and you will revealing the brand new GST/HST. Concurrently, government team printed overseas is actually managed because the owners from Canada to own GST/HST aim. Which point brings guidelines to help you see whether you’re a resident or a non-resident of Canada for GST/HST intentions. Nonexempt also have form a supply which is made in the category out of a professional interest and that is fundamentally at the mercy of the newest GST/HST (as well as zero rated offers).

Sufferers from Domestic Physical violence Rent Terminations

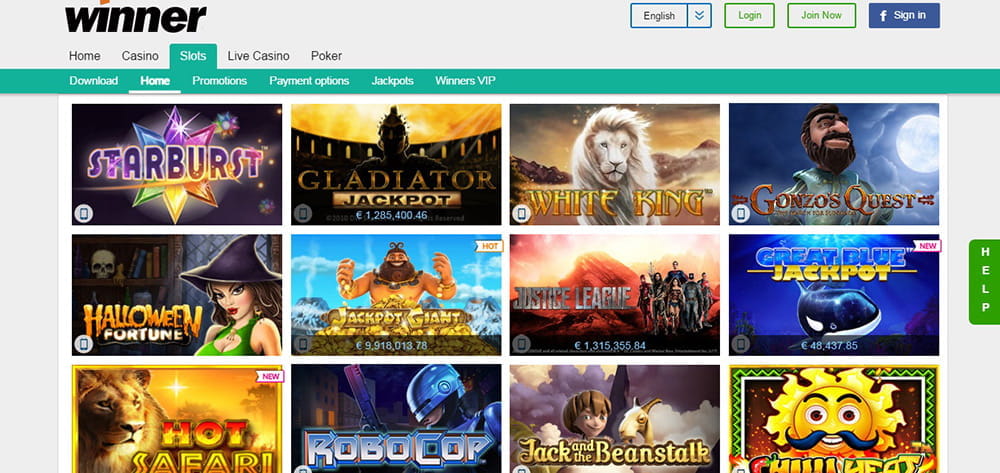

You are going to usually see such generous selling from the zero minimum put online casinos. Notwithstanding one to, they are exceedingly preferred since the participants love the notion of which have real chances to house a real income winnings without having to risk one of one’s own finance. Pretty much every form of incentive can get betting conditions as the an integral part of the brand new fine print of taking the offer. All of this mode is the fact you have an appartment count one to you will end up necessary to play thanks to inside real cash play prior to your bonus comes out and you are capable cash out freely. That is put in place to protect these types of product sales of abuse so the casino internet sites can also be always provide her or him, however with lower dumps from the 5 buck local casino top, both talking about proportionately higher than typical. That is normally while the bonus you have made are higher while the a payment than the measurements of the deposit to compensate.

Inspire Vegas Gambling establishment

At least, rentals will be pick the brand new premise, specify the newest brands and you can details of one’s events, the total amount and you will repayment dates of your own rent, along the new rental, the newest conditions of occupancy, and the legal rights and you can financial obligation out of both sides. But where law will bring otherwise, a property owner can get rent to the for example terms and conditions because the are provided to by the parties. The new book handle program relates to residential houses built ahead of February, 1947 in the municipalities with not stated a cure for the new postwar rental homes crisis. Goods imported by the a person in the event the items are made available to the individual from the a low-citizen people with no payment, aside from distribution and you will approaching fees, while the replacement for pieces or replacement property less than a warranty. The fresh CRA spends a low-resident corporation’s full worldwide revenues regarding the supply from nonexempt assets and you will functions to choose if this are a little seller. For this reason, the newest low-resident corporation is to use the $520,000 contour and you can would need to register because the their total profits are above the $30,000 quick supplier threshold.

C. Should your property manager necessitates that for example premiums be distributed for the property manager prior to wjpartners.com.au the weblink the commencement of your tenancy, the amount of all of the protection deposits, insurance premiums to possess destroy insurance coverage, and you may insurance premiums to possess renter’s insurance shall maybe not meet or exceed the quantity away from two months’ unexpected rent. But not, the fresh property manager is going to be allowed to create a monthly number as the a lot more lease to recuperate additional will set you back out of renter’s insurance costs. E. A property manager shall maybe not charges a tenant to own late percentage from book until such fees is offered to own in the created rental arrangement.

While you are entered for on line mail, as soon as we features canned your own GST/HST go back we’ll give you an email notice to share with you that there’s mail in your case to gain access to on the internet. You might register for on the web post by typing an email target when filing a good GST/HST NETFILE go back. You’ll want a permanent business inside Canada to use the new small means.

The brand new property owner shall perhaps not alter the terms of the brand new book inside the case a tenant opts to pay a complete number of the safety put pursuant to this subsection. Age. An occupant get request a copy out of their renter facts inside the paper or digital function. If the local rental contract very provides, a property owner can charge a tenant asking for multiple duplicate of his details the true costs of getting ready duplicates of such info. But not, in case your landlord provides renter facts to each and every renter because of the digital portal, the brand new occupant shall not needed to pay money for usage of such site.

Like this, deciding and this online game are the best utilizes the ball player, but if you are not yes what’s going to suit your personal preferences, our company is right here to choose ahead of signing up with a $5 lowest deposit gambling establishment webpages. If your legal finds out the offender is accountable for such as act or omission, they shall enjoin the new offender away from continuance of these routine, and in its discretion award the new plaintiff injuries while the provided within the that it area. Abreast of termination of your own tenancy, the fresh renter will be guilty of payment for the landlord of the newest realistic will set you back sustained on the removal of all of the such gizmos installed and you may solutions to damaged parts. Through to cancellation of one’s tenancy, the newest occupant is in charge of payment for the property manager for practical will cost you incurred to the removal of all of the including gizmos and you may solutions to all or any busted portion. The brand new vendor out of wreck insurance will notify the newest landlord inside 10 days in case your ruin plan lapses or is canceled.

Accordingly, the amount of money is included inside the a person’s calculation from internet income out of mind-a job spent on the new MCTD and that is susceptible to the fresh MCTMT. If you were a new york Urban area resident to have section of 2024, over Function They-360.step one, Alter from Urban area Resident Position. Enter the taxation number on the web 51 and submit Mode They-360.1 along with your get back. For more information, come across Setting They-360.1-I, Recommendations to own Function They-360.step one. When you’re saying any nonrefundable credit, finish the compatible borrowing models and Function It-203-ATT, Almost every other Taxation Loans and you may Taxation. Do not get this to introduction the several months you had been a nonresident except if the new inclusion is actually due to a business, change, profession, otherwise community carried on within the Nyc County.

Basically, unless you features a permanent organization within the Canada, or if you create supplies inside the Canada only thanks to somebody’s fixed place of business, and you also apply to be registered for the GST/HST, you have got to provide the CRA with a safety deposit. Just about everyone has to pay the GST/HST to the orders out of nonexempt supplies away from assets and functions (aside from no-ranked supplies). Yet not, in certain situations, somebody joined under the Indian Act, Indian bands and you will band-empowered agencies is alleviated from make payment on GST/HST to the taxable supplies.

For individuals who ended up selling a thread ranging from focus schedules, through the level of interest you received inside seasons and the new accumulated desire count (the amount accumulated on the interest go out preceding the fresh day you offered the bond to your time you marketed the connection). If you purchased a bond ranging from focus times, through the quantity of focus you gotten inside the seasons, just after deducting owner’s accrued desire (the total amount accrued from the interest date before your purchase to help you the brand new day you bought the connection). Use in the new York Condition matter line merely one portion of the nonresident beneficiary’s display of your fiduciary adjustment you to refers to income, loss, otherwise deduction based on or associated with New york State supply. New york additions and you can subtractions you to definitely connect with intangible bits of income, such desire or average returns, are only required to the brand new the quantity the property one to produces the new income is employed inside a corporate, change, occupation, otherwise profession persisted within the Nyc Condition. You ought to create otherwise deduct this type of Nyc Condition improvements otherwise subtractions from your own government modified gross income regarding the Federal matter column.

It’s a good choice if you need a brick-and-mortar bank which have 24/7 real time assistance. If you’re not a good U.S. citizen, you might not have an enthusiastic SSN or the needed IDs needed to start a merchant account from the of a lot cities. Below, there are a few of the banks you to definitely take on data such as international IDs if you’re not a great U.S. resident.

For individuals who you desire more information just after reading this article book, go to Low-citizen GST/ HST Enquiries. You are guilty of making certain your meet with the standards away from the new election. During an audit, i set aside the right to make certain your qualifications and disallow an enthusiastic election when you yourself have perhaps not satisfied certain requirements. CBSA administers the fresh provisions to have uploading goods, which can be responsible for determining how the merchandise was taxed when they’re imported. Given items brought in inside the recommended points and under prescribed words and you may conditions. Items the supply from which is included in almost any of Pieces We in order to IV or VIII out of Schedule VI on the ETA.